The Business of Dentistry

April 6, 2019 @ 8:00 am - April 7, 2019 @ 5:00 pm

$250 – $500

Details

Location: Westin South Coast Plaza, Costa Mesa CA

Price: $250 AGD members; $500 non-AGD members

Registration includes breakfast & lunch

Credits: 12 CEs (lecture)

Westin South Coast Plaza’s captivating stepped fountain garden space.

Saturday April 6, 2019

Employment Law 4 CE (lecture)

Employment lawsuits are continuing at an alarming rate. It is critical for all Dental Practice Owners to educate themselves in order to avoid (or prevail against) these very expensive claims. Learn the most important wage and hour rules and risks that leave California Dental Practices the most vulnerable. Handouts will include practical tools and information that you can use immediately in your own office.

Attendees will learn about:

- Independent Contractors – The New Rules & What They Mean

- Salary, Hourly or Production-Based Compensation – Requirements & Risks

- Exempt vs. Non-Exempt Status – Who Can/Cannot lawfully Be Paid a Salary

- The Five Requirements for Non-Exempt Employees & Why They Matter

- Rest Break Challenges and Dangers

- Overtime Pay & Bonuses – What is Required & How to Calculate It

- Alternative Workweek Schedules – Pros, Cons & Mandatory Steps

- Time Records, Payroll Records & Personnel Record Requests – What is Required

Tax Law Updates 4 CE (lecture)

The Tax Cuts and Jobs Act of 2017 significantly changed – but did not simplify – the US Tax Code. This presentation will help you understand what has and has not changed and will give you the knowledge you need to finish up the year and forearm you for the future. This is your opportunity to have a dental CPA answer the lingering questions you’ve had in the back of your mind – be sure to take advantage of it!

The Tax Cuts and Jobs Act of 2017 significantly changed – but did not simplify – the US Tax Code. This presentation will help you understand what has and has not changed and will give you the knowledge you need to finish up the year and arm you for the future. This is your opportunity to have a dental CPA answer the lingering questions you’ve had in the back of your mind.

Course Objectives:

• Tax Updates, and how it will affect dentistry

• Tax Planning advice

• Question and Answer session

Sunday April 7, 2019

California Dental Law 2 CE (lecture)

The course will review the laws of the Dental Practice Act and will review the numerous dental board cases applying such laws. The review of the laws and the cases shall give the attendee a better understanding on how the laws of the Dental Practice Act and their individual actions can impact their ability to practice dentistry in the state of California.

Objectives:

- Identify the legal limits on scope of practice and the use of dental auxiliaries.

- Describe the legal issues for renewal of license including CE and criminal history reporting.

- Design patient care, record keeping and staff management, to comply with the legal requirements of the Dental Practice Act

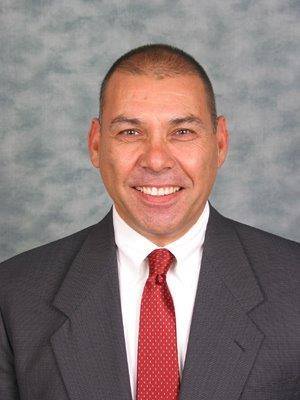

Taught by A. Lee Maddox (bio below)

Transitioning– Are you ready to Transition your practice? 2 CE (lecture)

(from Gary Takacs’ takacslearningcenter.com) “Practice transitions are a topic that is of interest to all Dentists. At some stage in your career you are likely to buy or start a practice, and hopefully after many years of success in practice you are likely to sell your practice. In these situations, you want to handle the transactions right the first time! The most valuable part of any practice is the patient base and this patient base is under no obligation to see the new dentist. However, the great news is that when a practice transition is done properly the vast majority of patients will stay with the practice and patient attrition is very low.”

Objectives:

• How do I get started?

• What are your options for transitioning your practice?

• What legal issues do I need to be concerned about if I sell my practice?

• What is the value of the practice?

• Associate Issues

• Sale of Practice

• Partnerships

Dr. Maddox practiced Endodontics and maintained two offices in Orange County for nine years. During this time, his endodontic practice experienced a 700% increase in production during this nine-year period. Dr. Maddox has served as a clinical instructor at the University of Southern California School of Dentistry and Loma Linda School of Dentistry. Dr. Maddox has been providing legal services to Dentists for over ten years, helping thousands of doctors with their transition needs as well as general legal services. He has been in the dental transition business as a Practice Broker since 2010. After three successful years as a dental practice broker, Maddox Practice Group was acquired by Henry Schein PPT, the dental practice transition division of Henry Schein Dental, in February 2013. After over 5 years as Vice-President and Regional Director for the western United States for Henry Schein, Dr. Maddox retired from Henry Schein and has re-opened his law practice. Dr. Maddox now enjoys practicing law full time in Costa Mesa and helping dentists, veterinarians and medical professionals.

REFUND & CANCELLATION POLICY

- Registrations are subject to a $50 non- refundable processing fee.

- Cancellations made by email prior to 3/16/19 will receive a refund less the $50 processing fee.

- Cancellations made after 3/16/19 are completely non-refundable.

- Transfer of a registration to another name will be considered by email request through 4/1/19.

REGISTRATION

Book Your Room for $199/nightSponsored By